StrikeWatch EA is not just another indicator – it is a complete options analytics workstation for MetaTrader 5, combining institutional-grade data, on-chart overlays and a robust engine into one coherent system.

MT5-native institutional workstation

StrikeWatch runs as a native MetaTrader 5 Expert Advisor – no external desktop apps, no web dashboards, no third-party bridges. You attach it to a chart and it turns that chart into a full options analytics console.

This keeps your workflow inside the platform you already use for execution, reducing friction, latency and cognitive load when moving from analysis to order placement.

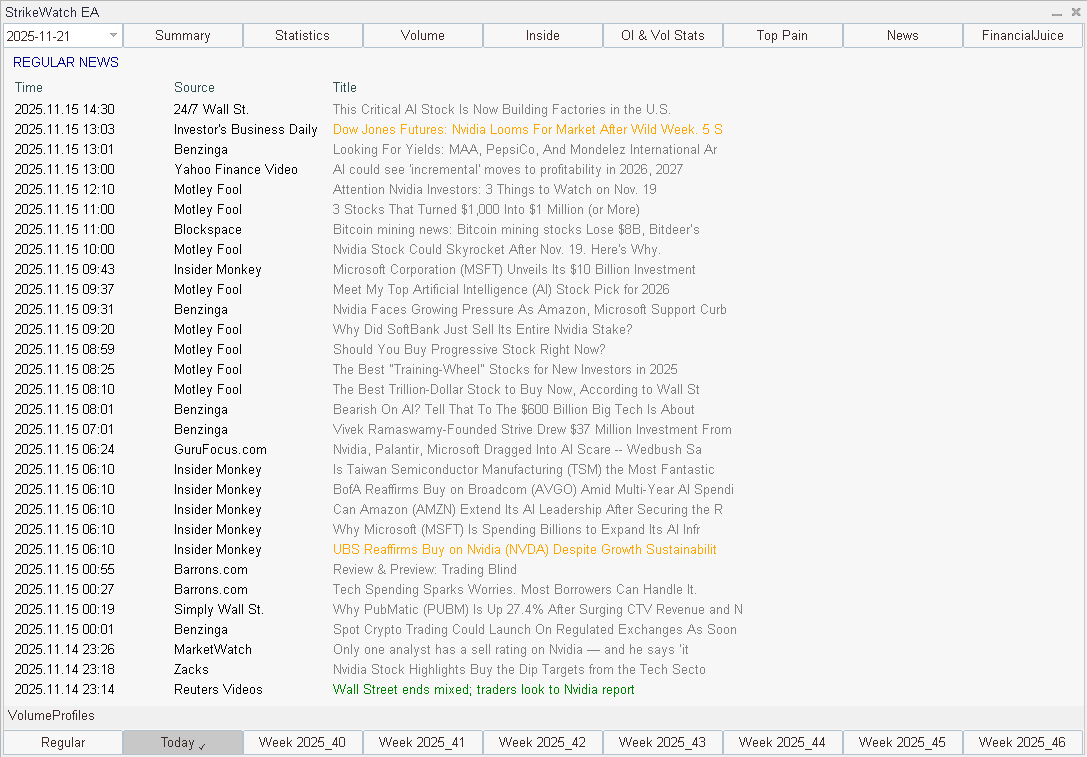

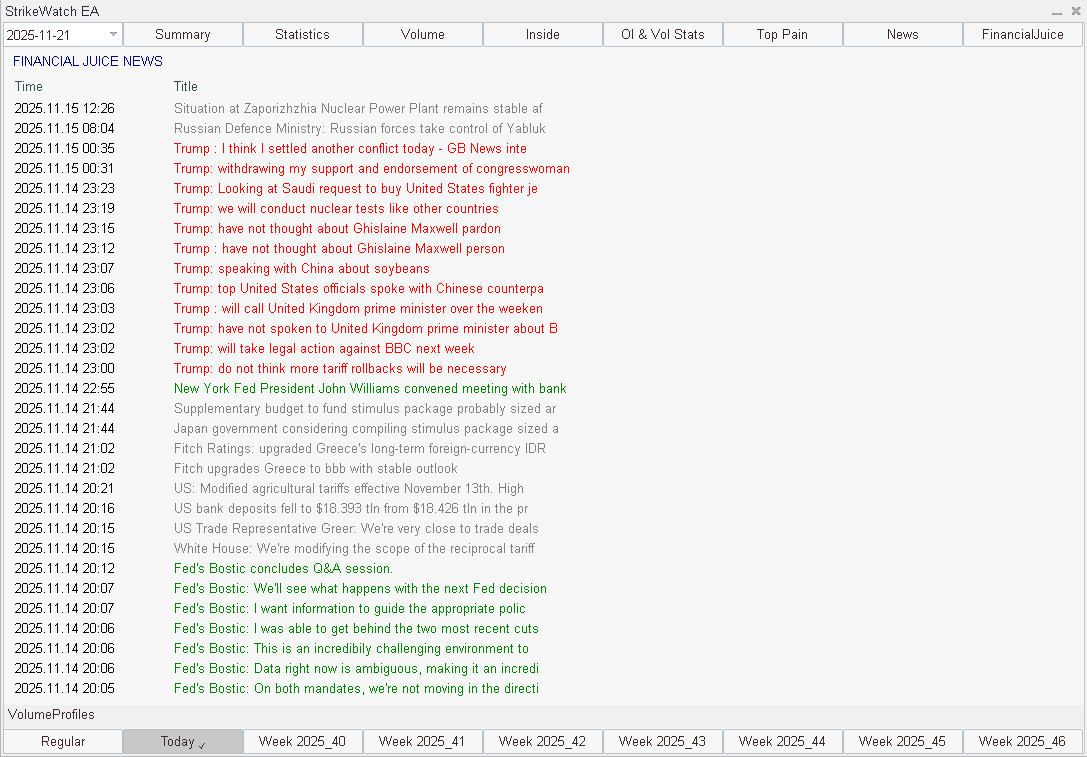

All critical intelligence in one console

The workstation combines options analytics (GEX, max pain, OI & volume stats, full-chain Greeks) with equity fundamentals, insider and short-interest data, ESG risk and curated news.

Instead of juggling ten browser tabs and multiple tools, you read the full risk/reward picture for each name from a single, structured MT5 panel before committing capital.

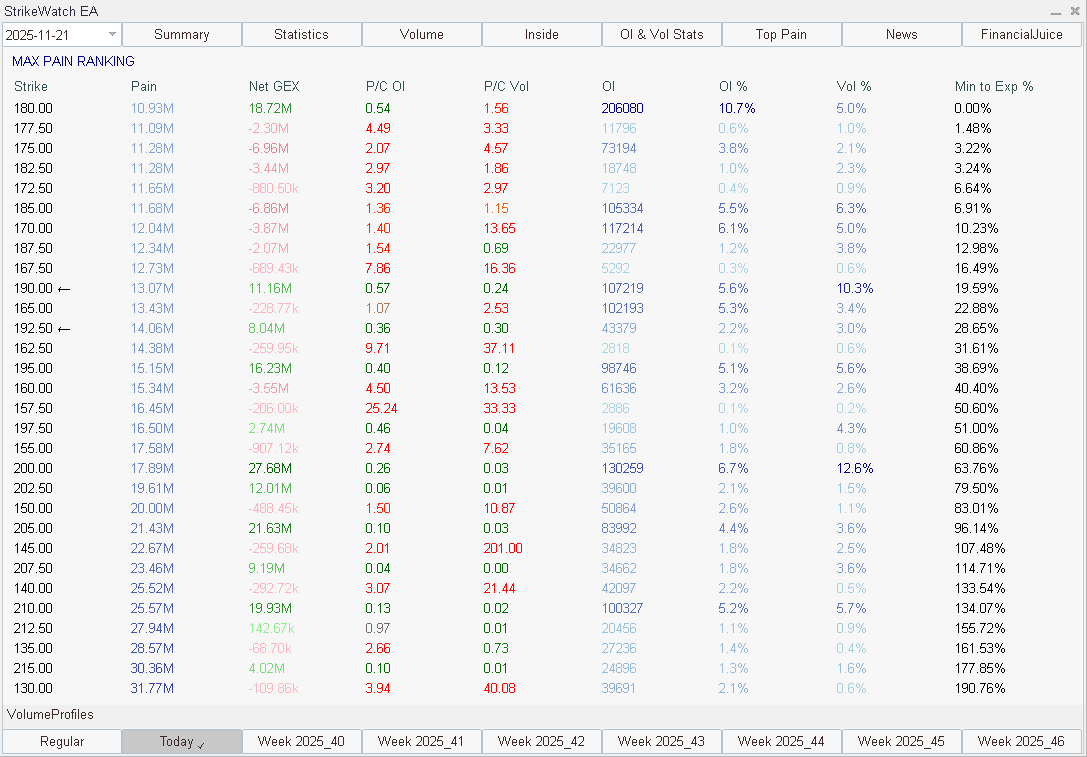

Options microstructure & dealer flows

StrikeWatch visualizes how options positioning shapes price: total and per-strike GEX, Zero Gamma Level, max pain rankings, call/put OI and volume distributions and a tape of large options trades.

You see where dealers are likely long or short gamma, which strikes act as pin magnets into expiry and where meaningful flow is actually going through the tape.

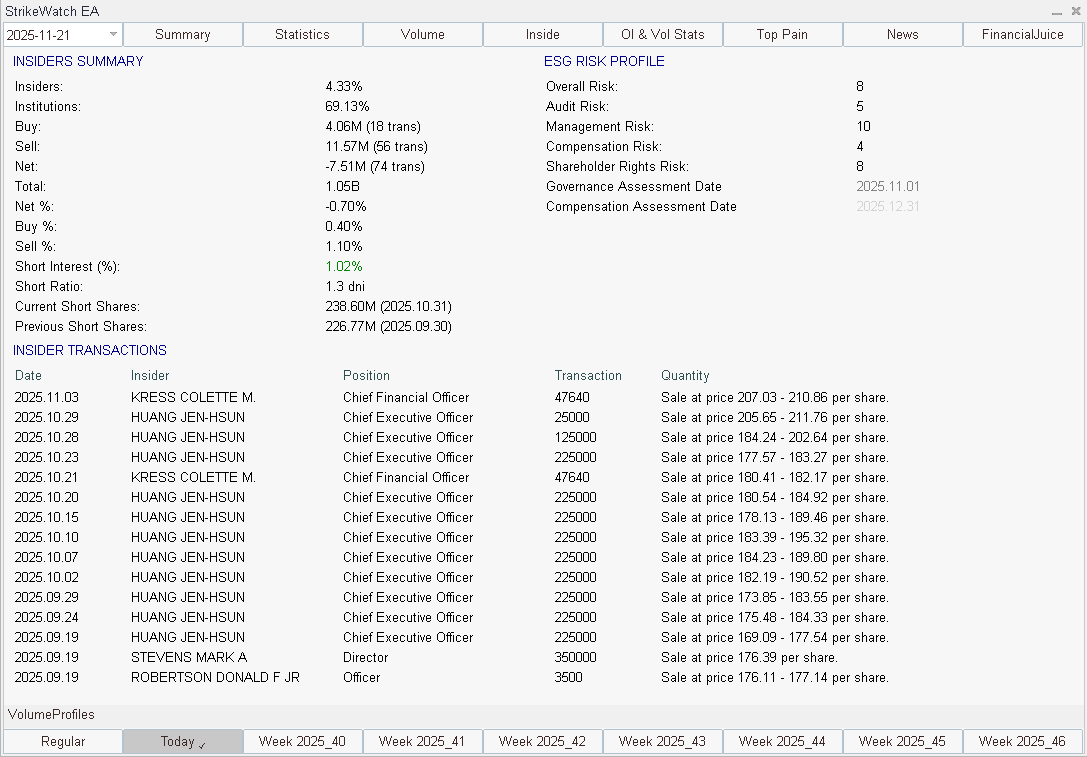

Fundamental, insider & ESG context

A six-panel fundamental dashboard organizes over 200 metrics into Price Performance, Valuation, Profitability, Balance Sheet & Liquidity, Growth and Ownership/Dividends, plus dedicated views for insiders, institutions and short interest.

This gives each options idea a proper equity backdrop, so you are not structuring trades purely on implied metrics without understanding the underlying company’s quality and positioning.

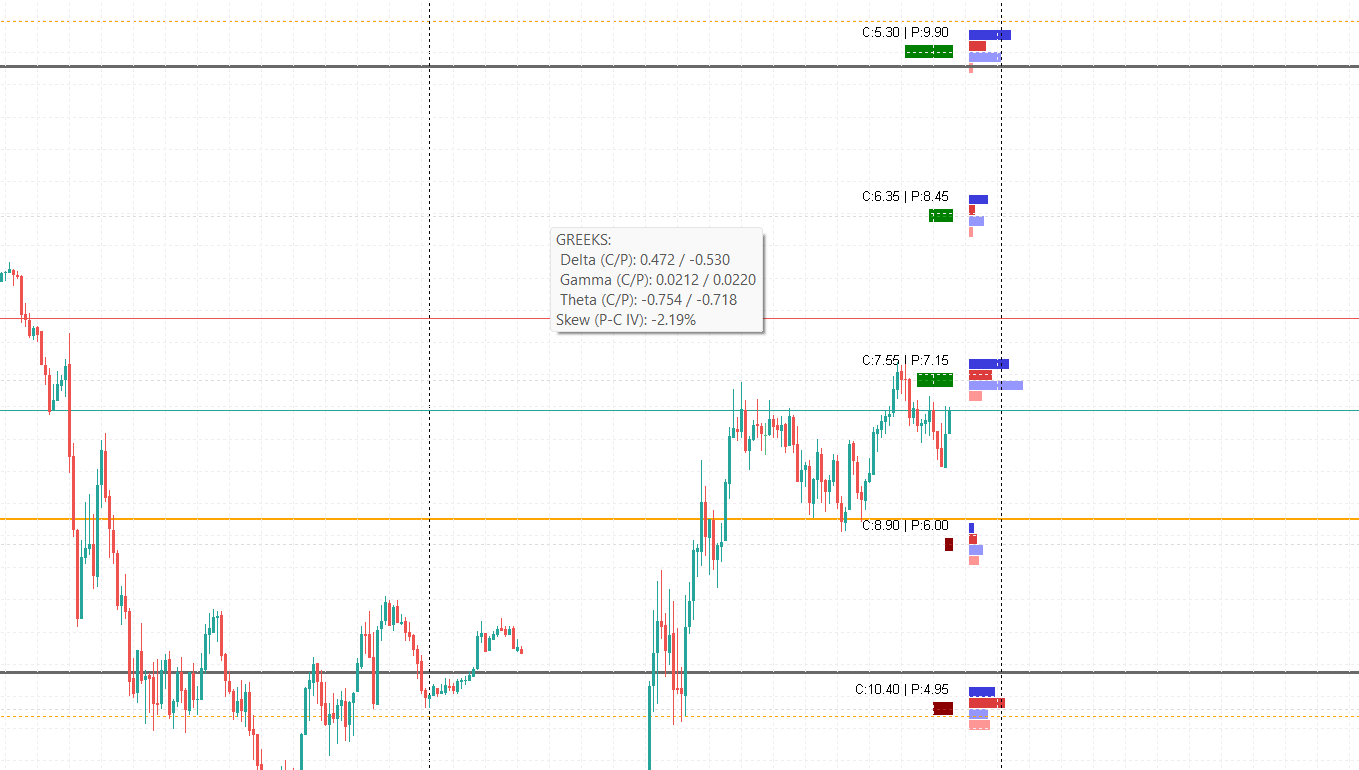

On-chart gamma & volume structure

The graphics engine overlays GEX bars, max pain and zero gamma levels, IV/HV/ADR bands and intraday/weekly volume profiles directly on your MT5 price chart as colored lines and histograms.

Entries, targets and stops can be aligned with real option and volume structure – high-volume nodes, thin liquidity corridors and dealer-driven zones – instead of arbitrary price levels.

Risk-first design for serious traders

StrikeWatch is built as an analysis workstation, not a signal generator or auto-trader. It exposes the full structure of the options market – GEX, max pain, OI and volume, Greeks, fundamentals and profiles – and leaves trade construction and execution entirely in your hands.

This risk-first approach keeps you in control of sizing, entries and exits while giving you the institutional-grade context dealers watch: where risk is concentrated, where pinning forces are strongest and where volatility regimes are likely to shift.